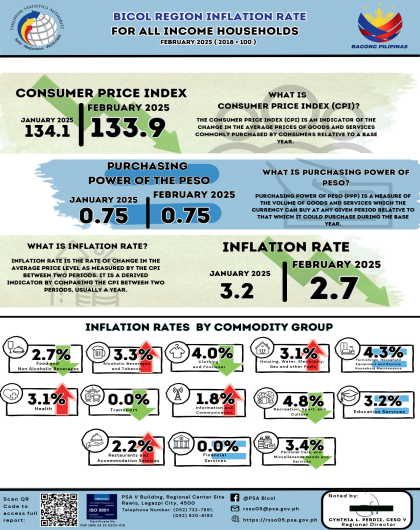

The headline inflation in Camarines Sur decreased to 2.5 percent in February 2025 from 3.1 percent recorded in January 2025. This brings the provincial average inflation to 2.8 percent. In addition, the inflation rate in February 2025 was lower by 0.9 percentage points than the inflation rate recorded in February 2024 at 3.4 percent.

I. Major Contributor to the Headline Inflation for February 2025

The major contributor to Camarines Sur’s overall inflation on February 2025 was Food and Non-alcoholic Beverages with an inflation rate of 2.3 percent. This equates to a 40.2 percent share or 1.00 point contributing to the province's inflation. The main contributor to the inflation in this commodity group is Meat with a 15.9 percent inflation rate. This accounts for 29.8 percent share, or 0.75 points.

Housing, Water, Electricity, Gas and Other Fuels was the second contributor to the province’s inflation rate with a 26.9 percent share or 0.67 points, while the third primary driver was Clothing and Footwear with an 8.5 percent share or 0.21 points.

II. Main Drivers to the Downtrend of the Headline Inflation

The uptrend in the overall inflation in February 2025 was primarily influenced by the slow year-on-year increase in Food and Non-alcoholic Beverages at 2.3 percent inflation from 3.2 percent in the previous month. The main contributor to the inflation in this commodity group is the Vegetables, tubers, plantains, cooking bananas and pulses which decreased from 40.4 percent recorded in January 2025 to 17.9 percent in February 2025.

The second contributor in the uptrend of the inflation is the slower increase in Transport which recorded -1.4 percent inflation in February 2025 from 3.7 percent in January 2025.

In addition, inflation rate in the following commodity groups also recorded a slow increase in prices:

1. Clothing and Footwear, 6.8 percent;and

2. Recreation, Sport and Culture, 3.1 percent.

On the other hand, the following commodity groups registered a faster increase in prices during the month of February 2025:

1. Alcoholic Beverages and Tobacco, 3.3 percent;

2. Housing, Water, Electricity, Gas and Other Fuels, 3.5 percent;

3. Furnishings, Household Equipment and Routine Household Maintenance, 2.9 percent;

4. Health, 4.0 percent; and

5. Restaurants and Accommodation Services, 3.7 percent.

Meanwhile, Financial Services recorded zero percent annual growth, while the following commodities retained the previous month’s inflation rate:

1. Information and Communication, 0.8 percent;

2. Education Services, 2.7 percent; and

3. Personal Care, and Miscellaneous Goods and Services, 2.2 percent.

Purchasing Power of Peso (PPP) is inversely related to inflation rate. Thus, as the inflation rate increases, PPP declines. Figure 4 shows that in Camarines Sur, PPP has been decreasing on the average of 0.04 annually from 2018 to 2024. The PPP in 2024 was 0.75. This implies that the PhP1.00 in 2018 as the base year, values only PhP0.75 in 2024.

CONSUMER PRICE INDEX (CPI)

The CPI is a measure of the changes in the average price level of goods and services that most people buy for their day-to-day consumption. It measures the composite change in the consumer prices of various commodities over time.

COMPONENTS OF CPI:

A. Base Period

The reference date or base period is the benchmark or reference date or period at which the index is taken as equal to 100. Starting February 2022, the base period is 2018.

B. Market Basket

A sample of the thousands of varieties of goods purchased for consumption and services availed by the households in the country selected to represent the composite price behaviour of all goods and services purchased by consumers.

C. Weighting System

The weighting pattern uses the expenditures on various consumer items purchased by households as proportion to total expenditure.

D. Formula

The formula used in computing the CPI is the weighted arithmetic mean of price relatives, the Laspeyre’s formula with a fixed base year period (2018) weights.

E. Geographic Coverage

CPI values are computed at the national, regional, and provincial levels, and for selected cities.

INFLATION RATE

The inflation rate is the annual or monthly rate of change of the CPI expressed in percent. Inflation is interpreted in terms of declining purchasing power of money.

HEADLINE INFLATION RATE

The headline inflation rate refers to the rate of change in the CPI, a measure of the average standard “basket” of goods and services consumed by a typical family.

YEAR-ON-YEAR INFLATION RATE

Year-On-Year Inflation Rate is the annual percentage change of CPI. For example, the percentage change of CPI between February 2024 and February 2025.

MONTH-ON-MONTH INFLATION RATE

Month-On-Month Inflation Rate is the monthly percentage change of CPI. For example, the percentage changes of CPI between February 2025 and January 2025.

PURCHASING POWER OF PESO (PPP)

The purchasing power of peso (PPP) shows how much peso in the base period is worth in the current period. It is computed as the reciprocal of the CPI for the period under review multiplied by 100.

For example, the PhP 1.00 in 2018 is valued only at PhP 0.75 in 2024.