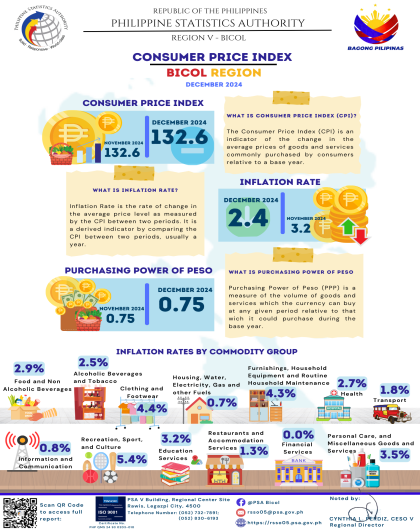

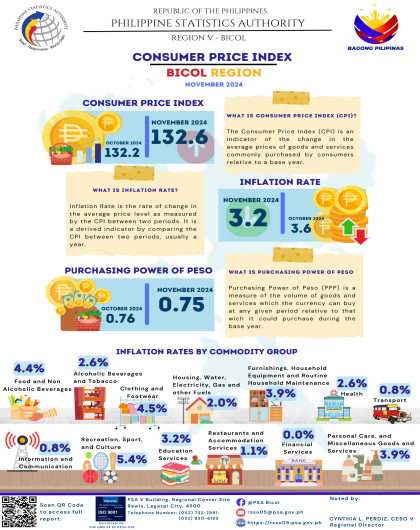

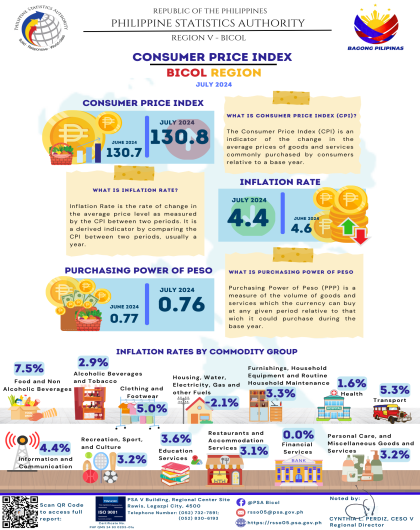

The headline inflation for Bottom 30% Income Households in Camarines Sur decreased to 5.3 percent in November 2024 from 7.8 percent recorded in October 2024. This brings the provincial average inflation from January to November 2024 at 5.9 percent. In addition, November 2023 inflation was lower by 2.6 percentage points compared to November 2024 inflation.

I. Main Contributors to the Year-on-Year Inflation

The main contributor to the inflation for Bottom 30% Income Households in Camarines Sur during November 2024 was Food and Non-alcoholic Beverages. This commodity group registered a 64.9 percent share or 3.44 points contribution to November 2024 Inflation.

Housing, Water, Electricity, Gas and Other Fuels was the second contributor to the Camarines Sur’s inflation rate with a 20.1 percent share or 1.07 points, while the third primary contributor was Transport with a 4.5 percent share or 0.24 points.

II. Main Drivers to the Downtrend of the Year-on-Year Inflation

The downtrend in the overall inflation for Bottom 30% Income Households for November 2024 was primary influenced by the lower inflation rate in Housing, Water, Electricity, Gas and Other Fuels at 6.5 percent from 19.5 percent in the previous month. Electricity recorded 15.6 percent inflation from 59.8 percent in October 2024.

Moreover, lower inflation rates were also noted in the following indices:

1. Food and Non-Alcoholic Beverages, 6.0 percent;

2. Alcoholic Beverages and Tobacco, 1.8 percent;

3. Clothing and Footwear, 7.4 percent; and

4. Transport, 4.1 percent.

On the other hand, the following commodity groups registered higher inflation rates during the month: Furnishings, Household Equipment and Routine Household Maintenance, 3.3 percent; Health, 3.1 percent; and Information and Communication, 0.8 percent.

Meanwhile, Recreation, Sport and Culture, Education Services, and Restaurant and Accommodation Services retained its previous month’s inflation rate, while Financial Services recorded zero percent annual growth.

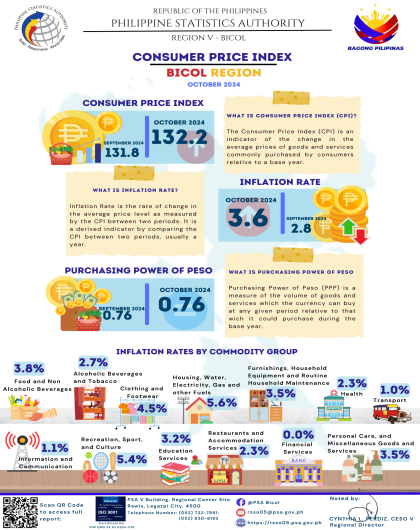

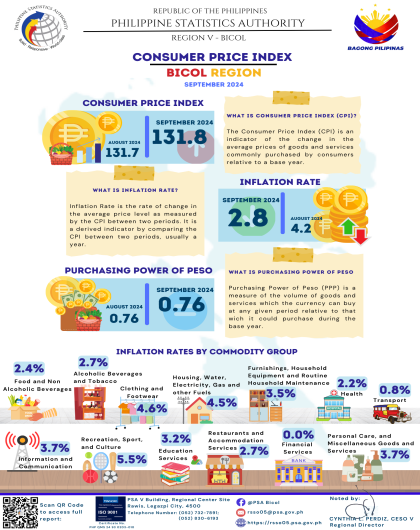

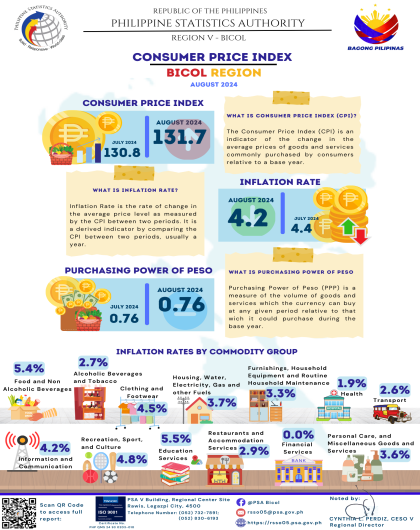

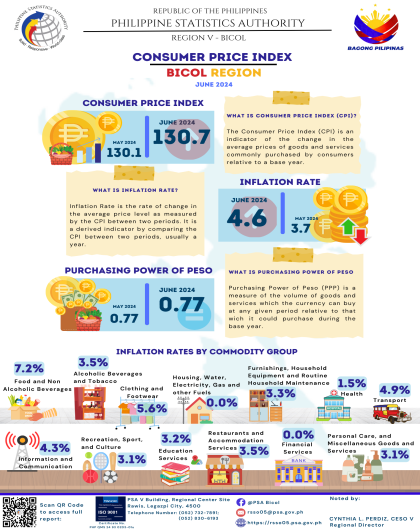

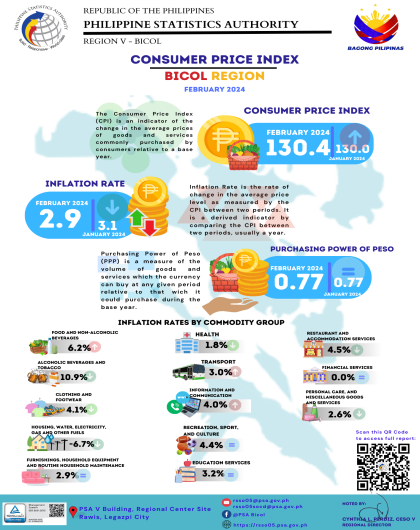

CONSUMER PRICE INDEX (CPI)

The CPI is a measure of the changes in the average price of a fixed basket of goods and services commonly purchased by an average Filipino household. It shows how much on the average, prices of goods and services have increased or decreased from a particular reference period known as base year.

COMPONENTS OF CPI:

A. Base Period

The reference date or base period is the benchmark or reference date or period at which the index is taken as equal to 100. Starting March 2022, the base period is 2018.

B. Market Basket

A sample of the thousands of varieties of goods purchased for consumption and services availed by the households in the country selected to represent the composite price behaviour of all goods and services purchased by consumers.

C. Weighting System

The weighting pattern uses the expenditures on various consumer items purchased byhouseholds as proportion to total expenditure.

D. Formula

The formula used in computing the CPI is the weighted arithmetic mean of price relatives, the Laspeyre’s formula with a fixed base year period (2018) weights.

E. Geographic Coverage

CPI values are computed at the national, regional, and provincial levels, and for selected cities.

INFLATION RATE

The inflation rate is the annual or monthly rate of change of the CPI expressed in percent. Inflation is interpreted in terms of declining purchasing power of money.

HEADLINE INFLATION RATE

The headline inflation rate refers to the rate of change in the CPI, a measure of the average standard “basket” of goods and services consumed by a typical family. It refers to the annual rate of change or the year-on-year change in the CPI.

For example, the percentage change of CPI between November 2023 and November 2024.

MONTH-ON-MONTH INFLATION RATE

Month-On-Month Inflation Rate is the monthly percentage change of CPI. For example, the percentage changes of CPI between November 2024 and October 2024.

CPI FOR THE BOTTOM 30% INCOME HOUSEHOLDS

The CPI for bottom 30% income households is an indicator of the change in the average prices of goods and services commonly purchased by consumers whose per capita income fall below the bottom 30%.

The estimated weights of 2018-based CPI for bottom 30% income households were based from the results of the 2018 Family Income and Expenditure Survey (FIES) for bottom 30% income households.