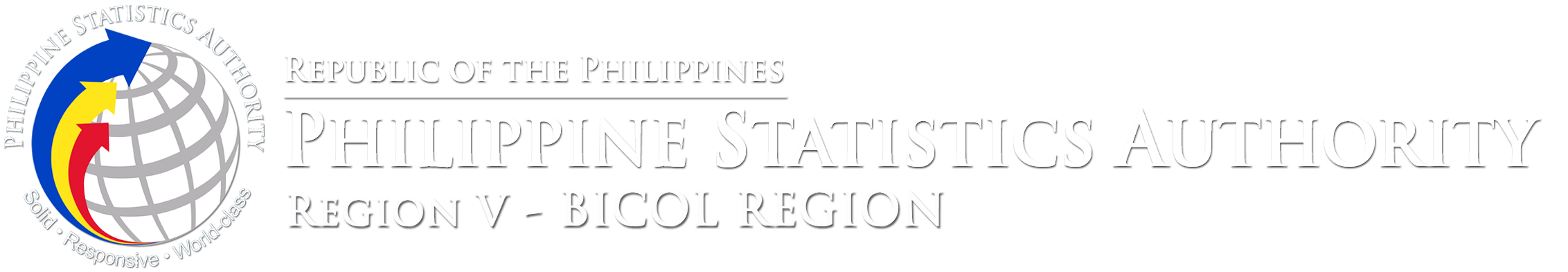

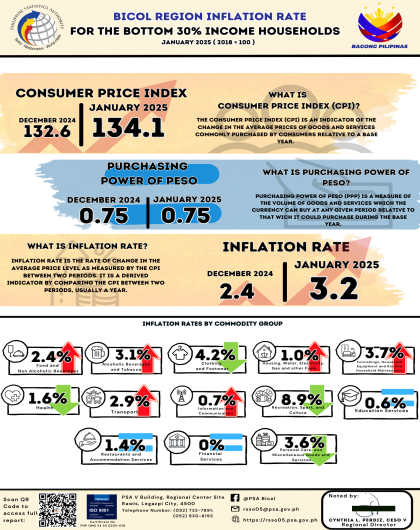

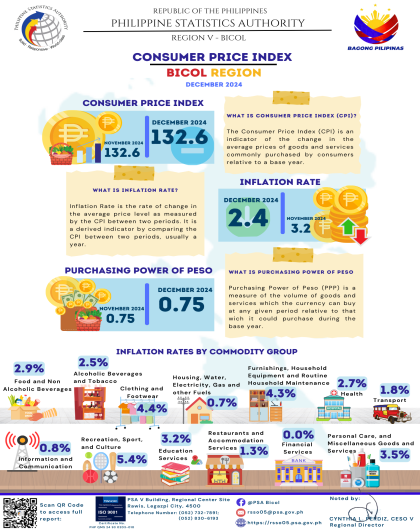

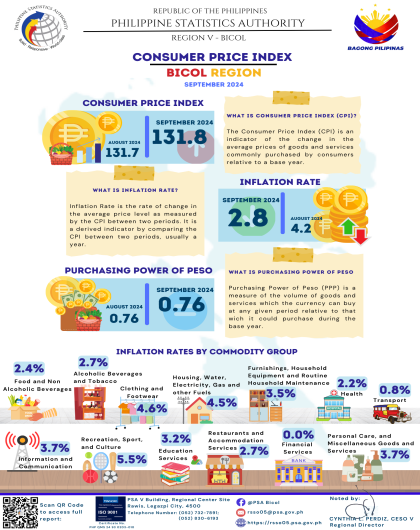

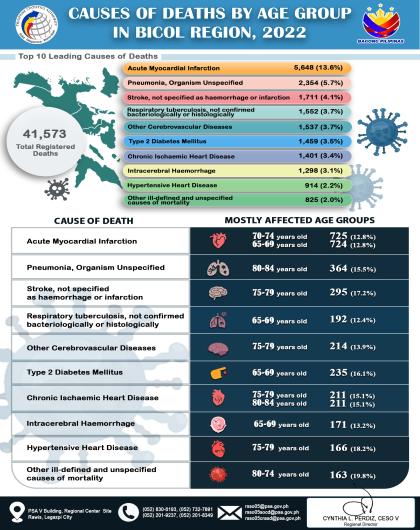

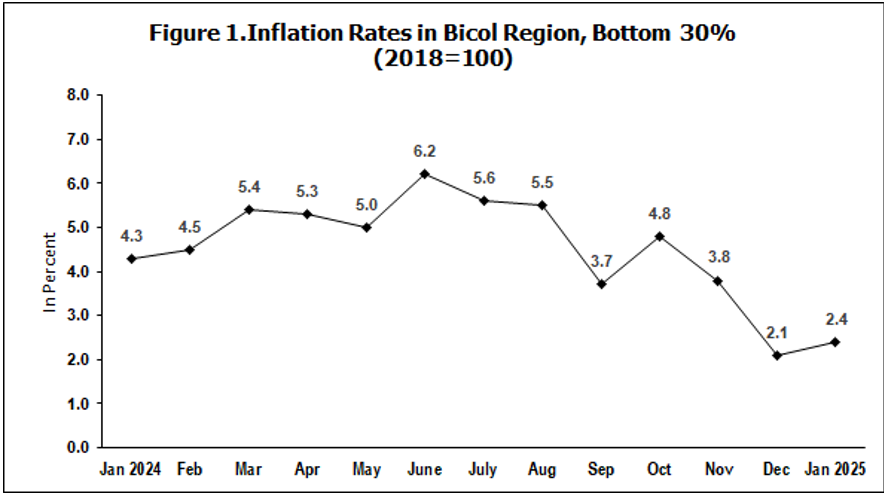

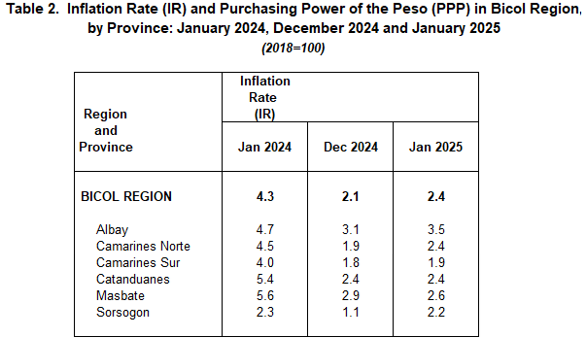

Overall Inflation

The region's inflation rate for the bottom 30% income households accelerated to 2.4 percent in January 2025 from 2.1 percent in December 2024. In January 2024, the inflation rate was posted at 4.3 percent.

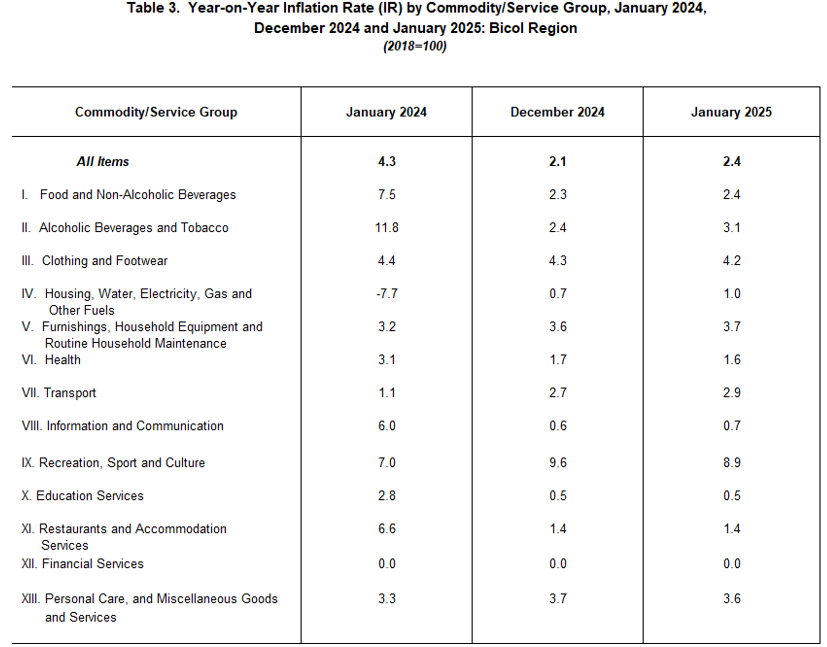

Main Drivers to the Upward Trend of the Overall Inflation

The upward trend in the overall inflation for the bottom 30% income households in January 2025 was primarily influenced by the faster annual increment in the heavily weighted food and non-alcoholic beverages at 2.4 during the month from 2.3 percent in December 2024. Also contributing to the uptrend was housing, water, electricity, gas and other fuels with a faster year-on year increase of 1.0 percent during the month from 0.7 percent annual increase in December 2024 and alcoholic beverages and tobacco at 3.1 during the month from 2.4 percent in December 2024

Faster annual increments were also noted in the indices of the following commodity groups during the month:

a. Furnishings, household equipment and routine household maintenance, 3.7 percent from 3.6 percent; and

b. Transport, 2.9 percent from 2.7 percent;

c. Information and communication, 0.7 percent from 0.6 percent.

In contrast, the following commodity groups registered lower inflation rates during the month:

a. Clothing and Footwear, 4.2 percent from 4.3 percent;

b. Health, 1.6 percent from 1 7percent;

c. Recreation, sport and culture, 8.9 percent from 9.6 percent; and

d. Personal care, and miscellaneous goods and services, 3.6 percent from 3.7 percent.

The indices of education services, restaurants and accommodation services, and financial services retained their respective previous month’s inflation rates in January 2025.

Main Contributors to the Headline Inflation

The top three commodity groups contributing to the January 2025 overall inflation were the following:

a. Food and non-alcoholic beverages with 59.0 percent share or 1.4 percentage points;

b. Personal care, and miscellaneous goods and services with 7.2 percent share or 0.2 percentage point; and

c. Transport with 7.2 percent share or 0.2 percentage point.

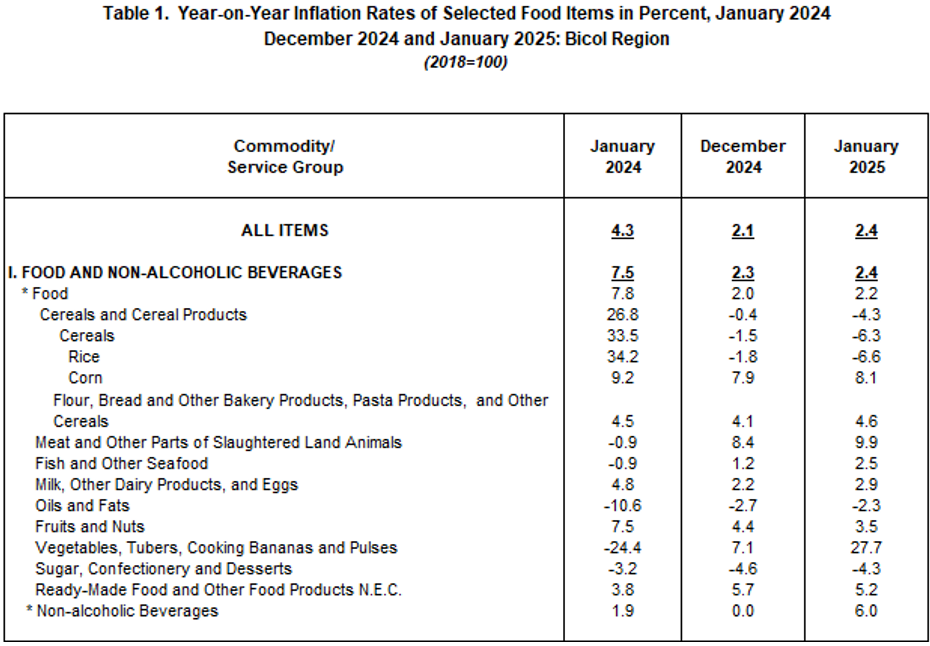

Food Inflation

Food inflation at the regional level increased to 2.2 percent in January 2025 from 2.0 percent in the previous month. In January 2024, food inflation was higher at 7.8 percent.

Main Drivers to the Upward Trend of Food Inflation

The acceleration of food inflation in January 2025 was primarily brought about by faster year-on-year increase in the index of vegetables, tubers, plantains, cooking bananas and pulses at 27.7 percent during the month from a 7.1 percent annual increase in December 2024. Faster annual growth rate was also observed in the index of fish and other seafood at 2.5 percent during the month from 1.2 percent and Meat and other parts of slaughtered land animals at 9.9 percent from 8.4 percent in December 2024.

Faster annual increments were also noted in the indices of the following food groups:

a. Corn, 8.1 percent from 7.9 percent;

b. Flour, bread and other bakery products, pasta products, and other cereals, 4.6 percent from 4.1 percent; and

c. Milk, other dairy products and eggs, 2.9 percent from 2.2 percent.

Moreover, slower annual decline were observed on the indices of oils and fats at 2.3 percent from 2.7 percent and sugar, confectionery and desserts at 4.3 percent from 4.6 percent.

Main Contributors to the Food Inflation

Food inflation shared 51.0 percent or 1.2 percentage points to the overall inflation in January 2025. The top three food groups in terms of contribution to the food inflation during

the month were the following:

a. Vegetables, tubers, plantains, cooking bananas and pulses, with a share of 95.3 percent or 2.1 percentage points;

b. Meat and other parts of slaughtered land animals, with a share of 57.7 percent or 1.3 percentage point; and

c. Fish and other seafood with a share of 17.9 percent or 0.4 percentage point.

DEFINITIONS AND CONCEPTS

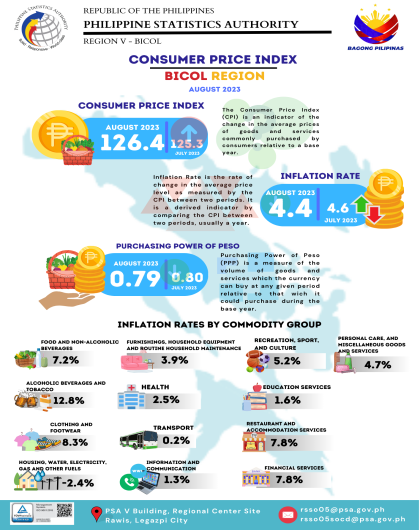

Consumer Price Index - a statistical measure of the change in average retail prices of a fixed basket of goods and services bought by a specific group of consumers in a given area in a given period of time.

Purchasing Power of the Currency or Peso (PPP) - a measure of the volume of goods and services which the currency can buy at any given period relative to that which it could purchase

during the base year. It is computed as the reciprocal of the CPI for the period under review multiplied by 100.

Market Basket - the total number of goods and services in constant amounts and qualities which are samples of the goods and services available in the market and included in the construction of the index. CPI market basket was selected to represent the composite price behavior of all goods and services purchased by consumers. Composition of the 2012 market basket was determined based on the results of the 2018 update of the 2012 basket. Provinces and selected cities had own market baskets.

Base Year - it identifies the base period with which the index relates. It is a period of time chosen as reference on which a price index is computed. The index for the base year is 100.

Retail Price - the actual price at which retailers sell a commodity on spot or earliest delivery, usually in small quantities for consumption and not for resale. It is confined to transactions on cash basis in the free market and excludes black-market prices and prices of commodities that are on sale as in summer sales, anniversary sales, Christmas sales, etc.

Percent Change - the percent point change expressed as percent of the index of the earliest date.

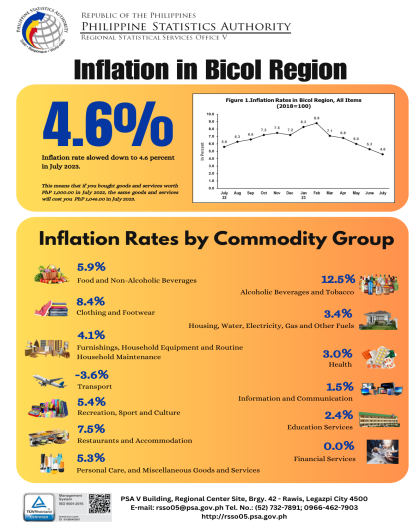

Inflation Rate - the annual rate of change or the year-on-year change of the CPI. Inflation is interpreted in terms of declining purchasing power of money.

Note to Users:

The monthly Consumer Price Index is computed based on the average retail prices of goods and services collected during the first week and mid-month of the reference month